Anúncios

Turkey’s dynamic economic environment, characterized by periods of high inflation and currency volatility, creates a complex landscape for borrowers.

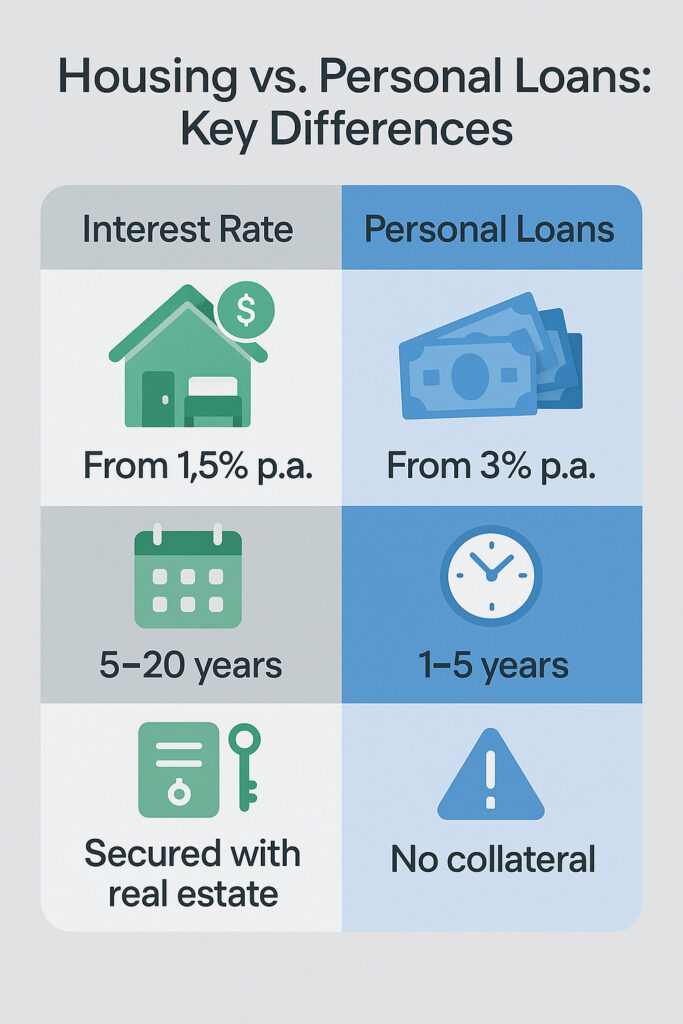

When considering financing options, understanding the real cost of borrowing—beyond nominal interest rates—becomes crucial. This article compares Turkey’s two most common loan types, Konut Kredisi (housing loans) and İhtiyaç Kredisi (personal/consumer loans), analyzing which offers the better value in real terms when inflation is factored into the equation.

By examining the structures, terms, and hidden advantages of each, we’ll provide guidance to help borrowers make financially sound decisions in Turkey’s unique economic context.

Understanding Nominal vs. Real Interest Rates in Turkey

Before diving into specific loan types, it’s essential to understand the distinction between nominal and real interest rates—a particularly important concept in Turkey’s high-inflation environment.

The Inflation Factor

Turkey has experienced significant inflation fluctuations in recent years. When evaluating loan costs, the nominal interest rate (the stated rate on loan documents) can be misleading without considering inflation’s impact. The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate:

Real Interest Rate = Nominal Interest Rate – Inflation Rate

In high-inflation environments, real interest rates can actually become negative, meaning borrowers effectively pay back less in real purchasing power than they borrowed. This creates strategic opportunities for certain types of loans.

Current Economic Context

As of 2025, Turkey has been implementing policies aimed at reducing inflation while managing economic growth. This balancing act directly impacts borrowing costs across different loan categories, creating divergent paths for housing and personal loan rates.

Anúncios

Housing Loans: Structure and Advantages

Housing loans in Turkey are designed specifically for property purchases and typically offer more favorable terms than general-purpose financing.

Key Characteristics

• Loan-to-Value Ratio: Banks generally finance up to 75-80% of the property’s appraised value

• Term Length: Typically 5-10 years, with some banks offering up to 15-20 years

• Interest Structure: Available in both Turkish Lira (TL) and foreign currencies (though foreign currency loans have additional restrictions)

• Security: The property itself serves as collateral

• Purpose Restriction: Must be used for residential property purchase

Nominal Interest Rates

Housing loan rates in Turkey are substantially lower than personal loan rates. As of 2025, typical ranges include:

• State banks (Ziraat, Halk, Vakıf): 16-20% annually for TL loans

• Private banks: 18-23% annually for TL loans

• Foreign currency-indexed loans (where available): 7-10% annually

However, these nominal rates tell only part of the story.

Personal Loans: Structure and Flexibility

Personal loans in Turkey offer flexibility in usage but come with higher stated costs due to their unsecured nature.

Key Characteristics

• Loan Amounts: Typically from 1,000 TL up to 100,000 TL (higher for premium banking customers)

• Term Length: Usually 3-60 months, with most banks capping at 36 months

• Interest Structure: Almost exclusively offered in Turkish Lira

• Security: Generally unsecured, though some banks offer secured options with lower rates

• Purpose Flexibility: Can be used for almost any legal purpose

Nominal Interest Rates

Personal loan rates are substantially higher than housing loans:

• State banks: 24-28% annually

• Private banks: 26-34% annually

• Digital banks and fintechs: 28-38% annually

These higher rates reflect the increased risk and lack of collateral for these loans.

Comparing Real Interest Rates: The Inflation Effect

| Loan Type | Typical Nominal Rate (2025) | Real Rate During High Inflation (35%) |

| Konut Kredisi (State Bank) | 18% | -17% |

| Konut Kredisi (Private Bank) | 21% | -14% |

| İhtiyaç Kredisi (State Bank) | 26% | -9% |

| İhtiyaç Kredisi (Private Bank) | 30% | -5% |

| İhtiyaç Kredisi (Digital Bank) | 35% | 0% |

| Foreign Currency Indexed Housing Loan | 8% + currency risk | Variable (depends on TL depreciation) |

As this table demonstrates, during periods of high inflation (illustrated with a 35% example), both loan types can effectively have negative real interest rates, with housing loans offering significantly better real rates. However, this advantage shifts during periods of moderate or low inflation.

The Term Length Advantage of Housing Loans

Housing loans gain an additional advantage through their longer available terms. When inflation remains high for extended periods, longer-term fixed-rate loans provide greater benefits to borrowers.

Since housing loans in Turkey can extend to 10-15 years (or sometimes longer), while personal loans rarely exceed 3-5 years, the housing loan provides a longer “hedge” against inflation.

Strategic Considerations for Different Economic Scenarios

The optimal loan choice depends significantly on your inflation expectations and personal financial situation.

High Sustained Inflation Scenario

If you anticipate inflation remaining high for several years:

• Best Option: Long-term, fixed-rate housing loans in Turkish Lira

• Why: Maximizes the negative real interest rate benefit over the longest period

• Strategic Approach: Maximize loan term length and amount (within affordable payment limits)

Moderate Inflation with High Volatility

If you expect inflation to fluctuate significantly:

• Best Option: Housing loans still offer better value, but with more moderate advantages

• Strategic Approach: Consider loans with interest rate cap features (offered by some Turkish banks)

Low Inflation or Disinflation Period

If you believe Turkey’s anti-inflation measures will succeed dramatically:

• Advantage Gap Narrows: The advantage of housing loans decreases as real rates become positive

• Strategic Approach: Shorter-term loans or loans with refinancing flexibility become more attractive

Beyond Interest Rates: Other Cost Factors

While real interest rates are crucial, other factors affect the total cost of borrowing in Turkey.

Tax Advantages of Housing Loans

Housing loans in Turkey come with potential tax benefits that further reduce their effective cost:

• Interest payments may be tax-deductible under certain conditions

• First-time homebuyers may qualify for additional tax incentives

• Some property transactions have reduced fees when purchased with a mortgage

These tax advantages are not available for personal loans, further widening the cost gap.

Fee Structures

Both loan types incur various fees, but they differ in structure:

Housing Loan Fees:

• Appraisal fee (expertise raporu): 0.5-1% of property value

• Mortgage establishment fee (ipotek tesis ücreti): Fixed fee at land registry

• Banking arrangement fee (kredi tahsis ücreti): Limited by regulation to 0.5%

• Fire insurance and life insurance: Required annually

Personal Loan Fees:

• Banking arrangement fee: Usually higher than housing loans, up to 1-1.5%

• Life insurance: Often required, but typically lower than for housing loans

• Early payment penalties: Generally higher than housing loans

Collateral Requirements and Risk

Housing loans require property collateral, which reduces risk for the bank but creates exposure for the borrower.

In a housing market downturn, borrowers might face negative equity situations—owing more than the property’s worth. Personal loans carry no such risk but compensate with higher interest rates.

Special Considerations for Expatriates and Foreign Residents

Foreign residents in Turkey face additional considerations when choosing between housing and personal loans.

Eligibility and Documentation

For housing loans, foreigners typically need:

• Residency permit of at least 12 months

• Foreign ID number (Yabancı Kimlik Numarası)

• Proof of income, often with higher stability requirements than for citizens

• Some banks may require a Turkish guarantor

For personal loans, requirements are often more stringent, with many banks having minimum residency periods of 2-5 years.

Currency Considerations

Expatriates earning in foreign currencies face both opportunities and risks:

• Income in strong foreign currencies may qualify for better loan terms

• However, repaying a TL loan with foreign currency income creates exchange rate exposure

• Some banks offer special programs for foreign currency earners with protective features

Frequently Asked Questions

Can inflation rates change the repayment terms of my loan?

No, once your loan is established with a fixed rate in Turkey, the nominal interest rate remains constant regardless of inflation changes. This is why fixed-rate loans become particularly valuable during high inflation—your payment remains the same while its real value decreases.

Are government-subsidized loans available for either loan type?

Yes, Turkey periodically offers subsidized loan programs, primarily for housing loans through state banks. These programs typically offer below-market rates for qualified borrowers (first-time homebuyers, certain professional groups, or lower-income families). Personal loan subsidy programs are less common but occasionally available for specific purposes like education or small business establishment.

How does the early repayment penalty differ between these loan types?

Housing loans in Turkey have legally capped early repayment penalties—maximum 2% for loans with remaining terms over 36 months and 1% for shorter remaining terms. Personal loans often have higher penalties, sometimes reaching 3-5% of the prepaid amount, though this varies significantly between banks.

Should I wait for lower interest rates before taking a loan?

In Turkey’s volatile economic environment, timing the market perfectly is challenging. Rather than trying to predict interest rate movements, consider your real financing needs and the real cost of the loan given current inflation. During high inflation periods, delaying a fixed-rate loan often costs more in real terms than proceeding despite high nominal rates.

Conclusion

When comparing Konut Kredisi and İhtiyaç Kredisi in Turkey’s inflationary environment, housing loans consistently offer lower real interest rates due to their lower nominal rates, longer terms, and tax advantages.

This advantage becomes particularly pronounced during high inflation periods, when real rates can turn significantly negative, effectively reducing the loan’s cost in real terms. However, the optimal choice depends on your specific needs, inflation expectations, and risk tolerance.

For major purchases where a housing loan is applicable, it almost always represents the better financial choice, while personal loans maintain their value for flexibility and accessibility despite their higher real cost