Anúncios

Getting a loan can be the key to achieving a dream, handling emergencies, or investing in your future. Whether it’s to buy a car, renovate your home, pay for education, or consolidate debts, loans have become a popular and accessible financial solution — especially for those living in the Netherlands.

However, choosing the right type of loan requires attention, knowledge of the available options, and good planning to avoid unnecessary debt. In this article, you’ll discover the most common loan types in the country, who should choose each one, and practical tips for managing your credit safely and smartly.

Main Types of Loans: Which One Is Right for You?

The Dutch financial system offers several personal credit options. Understanding these alternatives is essential to make a safe and informed decision:

1. Personal Loan

This is the most common loan type in the Netherlands. You receive a fixed amount and use it for any personal need, such as travel, home improvement, or large purchases.

Features:

• Fixed amount and repayment term;

• Monthly payments remain the same;

• Competitive interest rates;

Anúncios

• Ideal for planned expenses.

2. Secured Loan

In this case, you offer an asset (usually a car or home) as collateral, which significantly reduces the interest rate.

Features:

• Lower interest rates;

• Higher loan amounts available;

• Longer repayment periods.

Best for:People who own valuable assets and want better loan conditions.

3. Salary-Deducted Loan

Available for certain salaried employees or public servants, this loan is repaid through automatic deductions from your paycheck.

Features:

• Reduced interest rates;

• No missed payments — deductions happen automatically;

• Quick approval process.

Best for:Those with stable employment who value convenience and lower rates.

4. Online Loan

This type of loan is increasingly popular in the Netherlands, especially for those who prefer quick and paperless solutions.

Features:

• Fully online application;

• Less bureaucracy;

• Instant simulations and faster approvals.

Best for:Anyone looking for speed, simplicity, and digital convenience.

5. Peer-to-Peer Loan

This modern loan model connects borrowers and lenders directly through digital platforms.

Features:

• Intermediated by fintech platforms;

• Attractive interest rates;

• Accessible for people with a good credit history.

Best for:Those seeking an alternative to traditional banking systems.

Best Loan Management Apps in the Netherlands

Managing your loan repayments and finances is much easier when you use reliable mobile apps. Here are the most useful ones for residents in the Netherlands:

1. Mijn ING App

• Official app from ING Bank;

• View active loans and upcoming payments;

• Simulate new loan requests easily;

• Alerts and balance notifications.

2. ABN AMRO App

• Securely manage loans and bank accounts;

• Track monthly payments and loan conditions;

• Chat support and financial tools.

3. Rabobank App

• Real-time loan tracking;

• In-app loan simulations;

• Full integration with other Rabobank services.

4. N26 App (international but available in NL)

• A fully digital bank with modern interface;

• Budgeting tools and spending alerts;

• Supports expense tracking and financial planning.

Using these apps helps you avoid late payments, maintain good credit health, and stay in control of your finances.

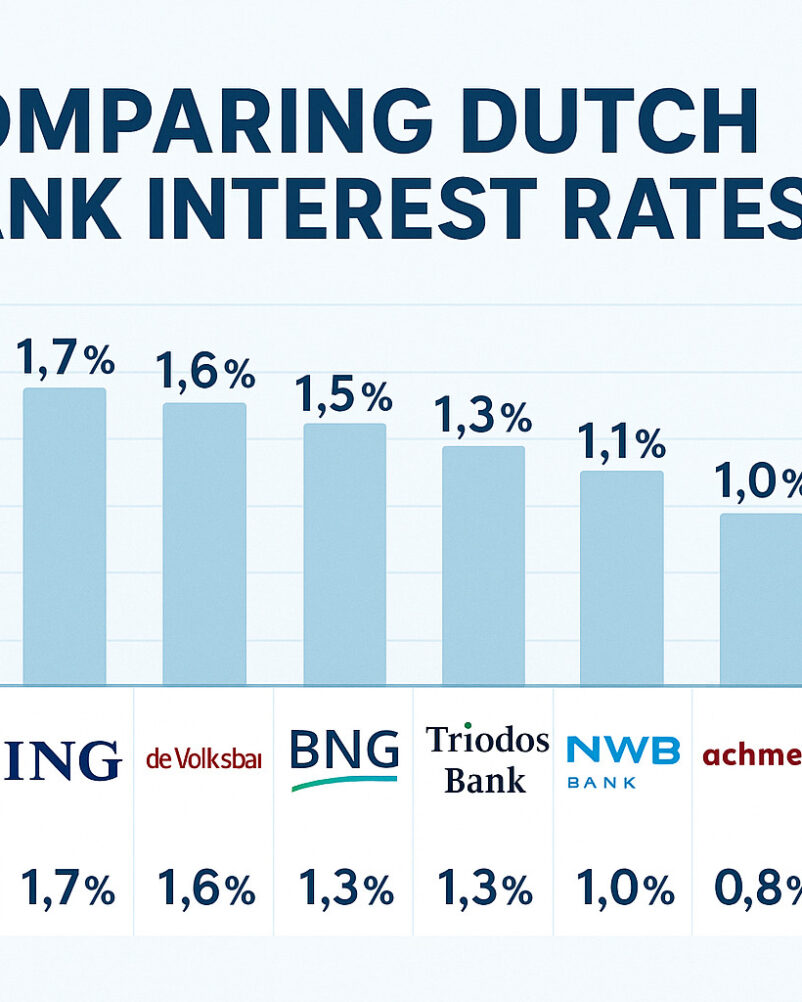

Before signing any loan agreement, follow these important steps:

• Use comparison websites like:

• Independer.nl

• Geld.nl

• Rente.nl

• Only borrow from licensed institutions;

• Read the contract carefully, especially the fine print;

• Avoid unnecessary refinancing, which increases long-term costs;

• Maintain a good credit history at BKR (Bureau Krediet Registratie) to improve your loan conditions.

Conclusion: Knowledge and Planning Make All the Difference

Living in the Netherlands and applying for a loan can be easy, fast, and beneficial — as long as it’s done wisely. With a variety of loan types available, from personal to secured and digital loans, it’s possible to find the perfect option for your profile and financial goals.

Using mobile banking apps, comparing offers, and planning ahead are key to making your loan work for you — not against you. When well managed, a loan is not a burden — it’s a solution.

Be informed, choose wisely, and take control of your financial journey.