Anúncios

Congratulations on reaching this crucial phase in your loan journey.

A preliminary analysis has determined that you are well on your way to finalizing your credit application, potentially granting you access to funds faster than you might expect.

It’s an exciting moment—one that underscores both the trust a financial institution is placing in you and the responsibility you’ll hold once you finalize the process. Before you proceed to confirm your pre-approval or examine the detailed results of your application, it’s essential to understand the broader landscape of financial loans and how each step intertwines to bring you closer to success.

This article will serve as a comprehensive guide, blending the crucial elements of the pre-approval stage, the implications of your credit analysis, and the final steps to secure your funds. Beyond that, we’ll dive into best practices, practical tips, and commonly overlooked details that can make the difference between a seamless borrowing experience and a stressful one. By the end, you’ll have the knowledge you need to confidently proceed to the final approval of your loan—potentially receiving your funds as soon as the same day.

From understanding interest rates and credit evaluations to learning how to interpret your preliminary results, you’ll discover how each piece fits into the bigger picture. Let’s begin by looking more closely at what a preliminary analysis means, why it’s so valuable, and how you can build on it to secure the best possible terms for your loan.

1. The Value of Preliminary Analysis

A preliminary analysis, sometimes referred to as a “pre-approval” phase, marks the lender’s first in-depth look at your financial profile. It differs from a generic rate quote in that the institution has already conducted some level of verification—whether checking your credit score, employment history, or reviewing the basic documents you’ve provided.

1. Initial Credibility:

Achieving a “pass” on your preliminary analysis indicates you meet the minimum requirements or risk thresholds set by the lender. While it’s not a guarantee of final approval, it’s a strong sign you’re on the right track.

2. Faster Processing:

By gathering necessary information early, lenders expedite the remainder of the application, saving valuable time. Often, a well-documented and accurate initial submission shortens the overall approval timeline.

Anúncios

3. Negotiation Leverage:

A positive preliminary assessment gives you the confidence to discuss interest rates, repayment terms, or additional perks from a position of relative strength. If the lender wants your business, you have an opportunity to request more favorable conditions.

4. Clarity of Next Steps:

The preliminary analysis typically includes a roadmap for final approval. You’ll know what extra documents or verifications remain, enabling you to gather the necessary pieces efficiently.

Quick Tip:

Even at this stage, maintain a cautious approach. Avoid taking on new debts, making large, unexplained deposits to your account, or neglecting existing payments. Lenders may run a final check before disbursing funds, and any major changes to your finances can raise flags.

2. Interpreting Your Preliminary Results

Seeing a message like “Great news! Your preliminary analysis is complete” can be thrilling, but it’s important to examine what the lender is actually communicating. Often, two primary elements accompany a pre-approval:

• Potential Loan Amount:

The preliminary analysis might indicate how much you qualify for under certain terms. This figure could shift slightly once you finalize your application, but it gives you a benchmark for planning.

• Proposed Interest Rate or Range:

In some cases, the lender shares a tentative rate you can expect if everything checks out during final verification.

While the exact format differs between institutions, they usually offer a chance to “view your result” or “view your analysis.” By clicking on these options or receiving a detailed email, you’ll gain insight into:

• Estimated Monthly Payments:

This helps you understand how a potential loan installment aligns with your current budget.

• Any Conditions or Special Requirements:

You may see a note indicating you need a co-signer, additional proof of income, or specific identification documents.

• Validity Window:

Preliminary approvals often have an expiration date. If you fail to provide the required documents before this date, you might have to start over.

Another Quick Tip:

Resist the urge to accept the maximum amount offered without thoughtful consideration. Always consider the debt-to-income ratio and the practical implications on your monthly finances. A higher loan limit might feel like more security, but it could strain your financial stability if not used wisely.

3. Final Steps Toward Approval

After reviewing your preliminary analysis, you stand just a few steps away from finalizing your loan. Though the specifics can vary, most lenders follow a similar checklist:

• Document Submission:

If the initial evaluation was based on limited documents, the lender might now request comprehensive bank statements, proof of employment, or additional supporting documentation.

• Verification Process:

Once you upload or present the documents, the lender’s underwriting team validates the accuracy of the data. They may verify employment details directly with your employer or run a more detailed check on your credit report.

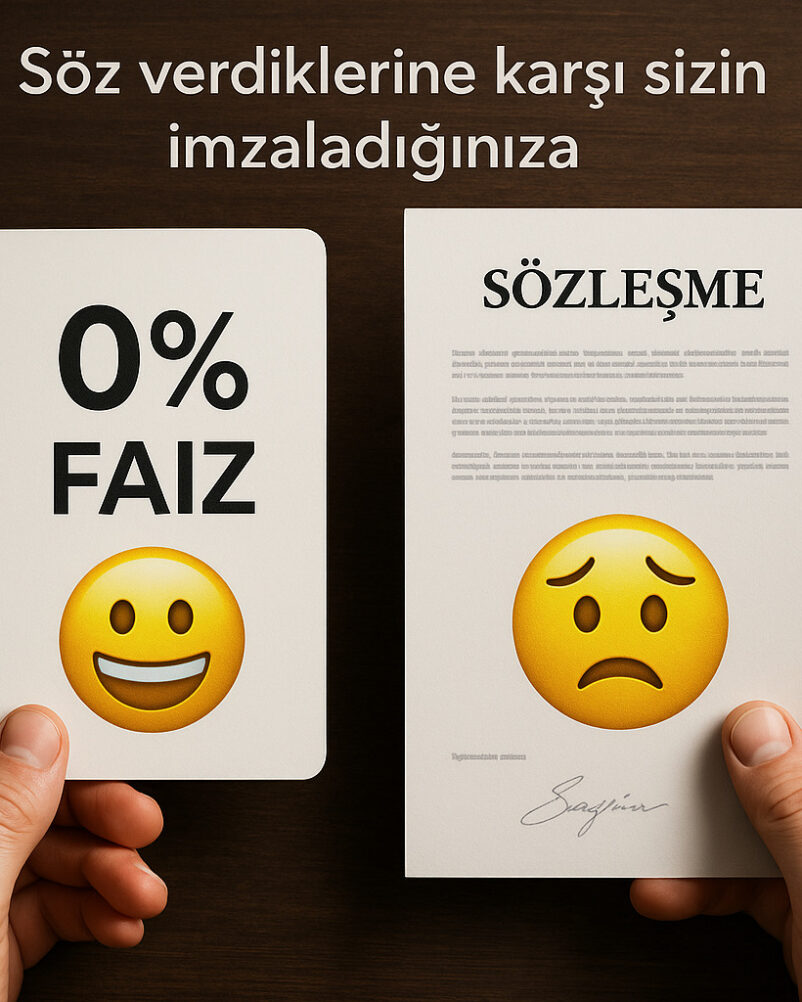

• Contract Review:

Assuming everything checks out, the lender will present a loan contract detailing the interest rate, repayment schedule, and any fees involved. Take time to read this thoroughly.

• Final Approval and Disbursement:

After you sign the contract (digitally or in person), the lender initiates the disbursement of funds. Depending on internal processes, the money can appear in your account immediately or within a few business days.

The strength of your preliminary assessment can influence how smoothly this phase goes. If you addressed most red flags early—such as shaky credit history or unverified income—your final approval might be swift. Conversely, any unresolved discrepancies or newly discovered concerns could delay funding or even lead to a denial.

4. Key Considerations Before Accepting the Loan

While the enthusiasm of seeing “Your credit can be available today” is understandable, it’s wise to pause and ensure you’re fully aware of the implications. Even the most favorable loan terms come with obligations. Before clicking “Finalize” or signing your contract:

• Interest Rate Accuracy:

Confirm that the rate listed in the contract matches or closely aligns with your preliminary quote. Any significant deviation should prompt immediate inquiry.

• Total Repayment Cost:

Beyond the monthly installment, consider the total interest paid over the life of the loan. Sometimes a slightly higher monthly payment but shorter term can save considerable money in interest.

• Fees and Charges:

Administrative, origination, or early settlement fees can add up. Make sure you see these explicitly outlined. Ask if there are penalties for paying off the loan sooner than the scheduled term.

• Long-Term Financial Health:

Contemplate your broader economic situation. Will these monthly payments remain feasible if your income changes or if emergencies arise?

Often, lenders will structure your repayment schedule in such a way that it’s manageable, but it’s still up to you to handle monthly budgeting responsibly. If any aspect feels uncertain, try speaking to a financial advisor or using online loan calculators to simulate various scenarios.

5. Common Types of Loans and Their Advantages

Though your specific application might be for a personal loan, it helps to know the general landscape of financial products. This knowledge not only contextualizes your current choice but can also guide future borrowing decisions:

1. Personal Loans:

Typically unsecured and used for various needs—from home renovations to debt consolidation.

2. Home Mortgages:

Long-term loans often tied to property. They usually come with lower interest rates but involve appraisals and stricter eligibility checks.

3. Auto Loans:

Collateral-based loans where the vehicle acts as security. Interest rates are often moderate, depending on the make and model.

4. Business Loans:

Targeted at entrepreneurs or established companies for expansion, equipment, or operational costs. They can be secured or unsecured, with varying interest rates.

5. Credit Lines:

Revolving credit that allows you to draw funds as needed up to a set limit. Best for fluctuating expenses and short-term needs.

When evaluating your final contract, understanding how personal loans stack up against these other products can show whether you’ve made the right choice. For example, if you plan to purchase a car, an auto loan might offer more favorable terms than a general loan.

6. How Interest Rates Affect Your Final Approval

Interest rates lie at the heart of your financial obligations. A fraction of a percentage point may not appear consequential on paper, but over time, it can translate to thousands of lira in either extra costs or savings.

• Fixed vs. Variable Rates:

A fixed rate remains the same over the loan term, providing predictable monthly payments. Variable rates fluctuate with market conditions, introducing some uncertainty but sometimes starting lower.

• APR (Annual Percentage Rate):

This figure encapsulates not just the interest but also any fees or insurance costs, offering a clearer snapshot of the loan’s total expense.

• Rate Adjustments:

If your credit score improves between the preliminary analysis and final approval, you might negotiate a better rate. Conversely, a slip in your credit status (e.g., missed payments) can push your rate higher.

Banks and financial institutions often use your credit score, debt-to-income ratio, and economic indicators to finalize the rate. If you maintain strong financial discipline up until the final contract, the more likely you’ll see terms that match or exceed your initial pre-approval expectations.

Quick Tip:

If you receive a final rate higher than expected, don’t hesitate to compare offers from rival lenders—sometimes a competitor might still offer better conditions based on your updated credit information.

7. Real-Life Voices: Success Stories

Testimony from Istanbul – Elif, 30

“When I saw the message about my preliminary loan approval, I was thrilled. I quickly uploaded the extra documents, and the bank approved my loan in just two days. Because I made sure my credit score stayed high, I even negotiated a slightly lower interest rate than the one first quoted!”

Testimony from Ankara – Murat, 41

“I had reservations about the preliminary analysis; it felt too good to be true. But it turned out to be straightforward. I just needed to provide a few documents verifying my freelance income. My loan was deposited into my account the very next day, and I used it to consolidate several high-interest debts.”

8. Managing Post-Approval Responsibilities

Once you confirm the final contract, your lender releases the funds. Whether you get them on the same day or within a short timeframe, the real responsibility starts now. Here’s how to manage your loan effectively:

1. Set Up Auto-Pay:

Enabling automatic payments can prevent missed due dates and keep your credit record pristine.

2. Track Expenses:

Maintain a personal budget spreadsheet or use an app. Seeing a clear snapshot of where your money goes each month helps you spot potential overspending.

3. Maintain Communication:

If you ever face financial hardship—like losing a job—contact your lender immediately. They might provide restructuring options or temporary relief.

4. Review Statements Regularly:

Make sure each monthly statement reflects the agreed-upon interest rate and no additional fees have been erroneously applied.

5. Early Repayment Strategy:

If you have the means, consider making extra payments toward the principal. This can save you interest costs and accelerate the payoff timeline. But confirm whether your contract imposes prepayment penalties.

Managing your new financial commitment well not only fosters peace of mind but also sets you up for future lending opportunities, as a track record of timely payments boosts your creditworthiness.

9. Useful Quick Tips for Finalizing Your Loan

• Revisit Your Budget:

Before signing, do a thorough budget check to confirm you can comfortably handle the monthly installments.

• Digital vs. In-Person Signing:

Opt for digital if offered. It’s faster and often comes with fewer overhead costs, which might translate into slightly lower fees.

• Ask About Discounts:

Some lenders offer discounted interest rates to clients who hold payroll accounts or multiple products.

• Stay Alert for Scams:

If any request seems suspicious—like asking for upfront payments or personal information that shouldn’t be required—verify its legitimacy with your bank directly.

10. Relevant Statistics on Loan Approvals

• High Pre-Approval Rates:

Banking association figures show that roughly 40-50% of applicants who receive a preliminary yes go on to secure final approval without hitches, a testament to the thoroughness of initial screenings.

• Document-Related Delays:

Around 20% of potential borrowers face hold-ups due to incomplete or incorrect documents. Promptly providing everything requested can accelerate disbursement.

• Interest Rate Sensitivity:

Surveys highlight that over 60% of borrowers state interest rates as the primary factor in finalizing a loan, outranking even fees and reputation of the lender.

• Default Rates:

While defaults for personal loans remain relatively moderate, they spike during economic downturns. Ensuring you have a safety net can protect both you and your lender from financial distress.

These data points reinforce the significance of fulfilling application requirements accurately and recognizing the strong role interest rates play in the decision-making process.

11. FAQs on Pre-Approval and Final Loan Steps

1. Will my final approval always match the amount in my preliminary analysis?

Not necessarily. The lender might adjust the final amount after a deeper review of your finances or if new information surfaces. However, if your situation hasn’t changed dramatically, you’ll likely receive close to the initial figure.

2. How long do I have to complete the final steps after pre-approval?

It varies by lender, but pre-approvals typically expire within a few weeks to a few months. If you miss that window, you might need to reapply or provide updated information.

3. Is the interest rate in my pre-approval guaranteed?

Not until you sign the final contract. While many lenders strive to honor the preliminary rate if your profile remains consistent, fluctuations in market conditions or changes to your credit score can lead to adjustments.

4. Can I use the loan for purposes other than what I stated initially?

It depends on the loan type. Personal loans generally come with more flexibility, but if you applied for a business or auto loan, the funds might be restricted to the stated purpose. Confirm the lender’s policy to avoid breaches of contract.

12. Related Topics

• Credit Score Fundamentals

• Debt Consolidation Options

• Short-Term vs. Long-Term Loans

• Refinancing Strategies

• Online vs. Traditional Bank Loans

Moving Forward with Confidence

The road from preliminary analysis to final loan approval can be both exhilarating and daunting. Receiving a positive preliminary assessment is a major milestone, signaling that lenders view you as a suitable candidate. However, it’s only the penultimate step in your journey—one that involves careful reading of loan contracts, thoughtful budgeting, and open communication with your lender.

By understanding the importance of your credit score, staying mindful of interest rates, and actively addressing any conditions flagged during the analysis, you position yourself for a smooth, successful completion. In many cases, you could be just a few signatures away from having immediate access to the funds you need—perhaps even later today.

Let this be your guide, a map that clarifies both the excitement and responsibilities awaiting you. Armed with these insights, you can secure a loan that not only meets your present needs but also supports long-term financial wellness. Whether your goal is to consolidate debts, invest in a small business, or cover an unexpected expense, a well-managed loan can be a powerful steppingstone toward brighter financial horizons.