Anúncios

Garanti BBVA offers special interest rates that many borrowers in Türkiye find appealing.

Their 20,000 TRY loan plan stands out for its 1.05% monthly fee.

In this article, you will discover how the offer works, who can qualify, and why it might be beneficial for urgent needs or strategic financial planning.

1. Overview of Garanti BBVA’s Special 20,000 TRY Loan

Garanti BBVA ranks among the most recognized banks in Türkiye, known for its blend of tradition and forward-thinking digital platforms. Their new promotion—highlighted as special interest rates for a 20,000 TRY personal loan—seems tailor-made for individuals requiring quick financing. Whether you need funds for urgent medical costs, a long-overdue home renovation, or bridging short-term expenses, this offer stands out primarily because of its relatively low monthly rate of 1.05% interest and the convenience of receiving same-day disbursement if approved early.

A key point is the maximum 60-month repayment schedule, giving you the flexibility to customize monthly installments so they fit your budget. Many borrowers appreciate having more time to spread out payments, thus minimizing the risk of missing due dates. On the other hand, you could opt for a shorter term if you want to settle the debt quickly, which might reduce the total interest paid. Observing how a 20,000 TRY loan influences your monthly finances is critical. Generally, the bank’s official calculators help predict the approximate installment you’d owe each month, factoring in the nominal interest as well as any administrative fees or insurance costs.

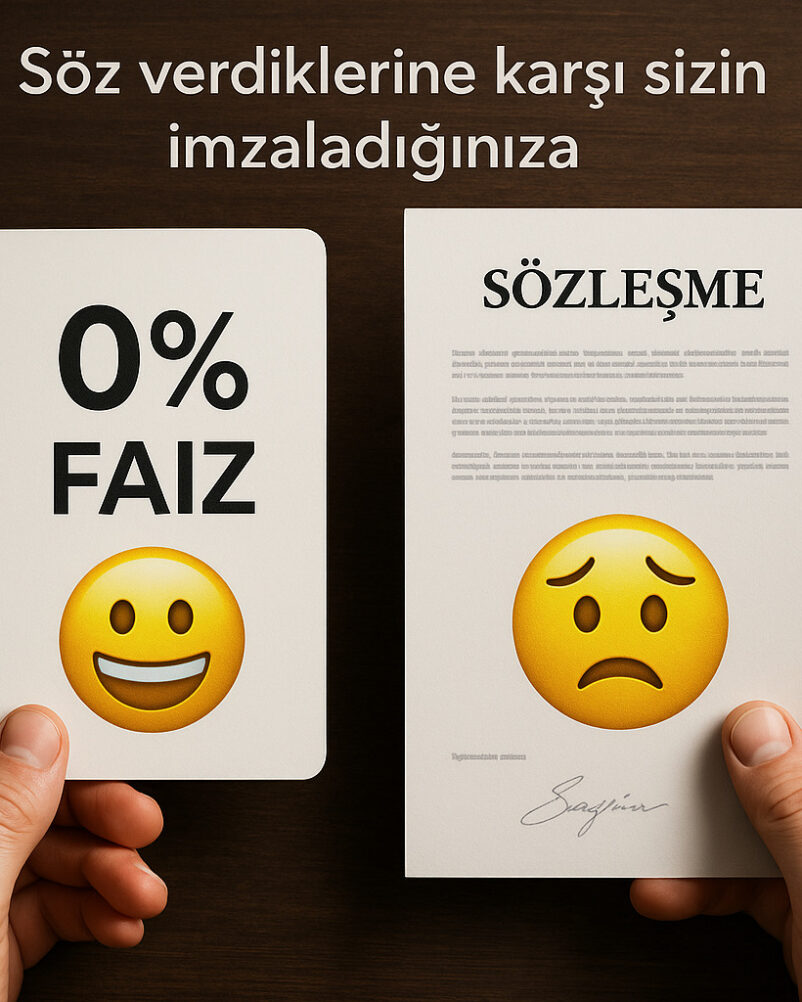

We must clarify that even though the monthly rate is only 1.05%, the effective rate can shift upward after all charges and possible taxes are included. That’s why prospective borrowers often consult the Custo Efetivo Total (CET) or the Annual Percentage Rate (APR) to see a more accurate cost figure. If you aim to use this loan for consolidation—like paying off a higher-interest credit card—this 1.05% monthly might represent significant savings. Conversely, if you only need short-term capital for a small purchase, verifying that no additional opening fees outweigh the interest advantage is vital. By reading every clause and comparing it to other banks’ proposals, you can feel confident about whether this Garanti BBVA arrangement aligns with your financial goals.

Quick Tip:

Consider how soon you truly need the funds. If your purpose can wait a few extra days or weeks, you might compare multiple banks before deciding. A difference of 0.1% monthly can add up to notable savings over 60 months.

2. Who Is Eligible and How to Apply

Before you rush to sign up for Garanti BBVA’s special 20,000 TRY loan, it helps to know their general eligibility criteria. Typically, you should present stable income evidence—like pay slips or tax records—demonstrating that monthly installments remain within your means. Borrowers with a positive track record of paying other obligations (credit cards, prior loans) usually enjoy a smoother process. Even if your credit isn’t pristine, the bank might consider your request if you can provide evidence that your finances have stabilized recently.

Anúncios

The application routine involves filling out an online form or visiting a local branch to discuss the conditions. If you opt to apply digitally, the bank’s platform typically performs real-time checks with Türkiye’s credit registry, scanning for red flags such as past defaults. You might also be asked for an official ID, proof of residency, and your TC number for further identification. Should you meet these checks, a preliminary approval might happen quite fast, especially if you apply during standard working hours.

Some borrowers wonder whether they need to open a Garanti BBVA checking account or sign up for extra products to secure the best rate. While it can improve your chance of obtaining the 1.05% monthly deal, it isn’t always mandatory. Often, the bank might sweeten the interest rate if you let them auto-debit installments from your brand-new or existing account. That arrangement ensures on-time payments with minimal administrative steps. Overall, applying is not overly complicated. The key is readiness: gather your documents, verify your credit score, and decide on how many months you want to repay. The more thoroughly you plan, the higher your success rate in walking away with the specialized rate and a quick disbursement.

3. Understanding the 1.05% Monthly Rate and 60-Month Repayment

Though 1.05% monthly might seem like a small figure, be mindful that it accumulates across the entire loan period. The chance to extend repayment up to 60 months is a double-edged sword: while it lowers your monthly outlay, it also results in a longer exposure to interest. If, for instance, you intend to pay back the 20,000 TRY in a short timeframe (like 12 to 24 months), you could minimize total interest charges, but your monthly payments would jump significantly. Meanwhile, opting for 60 months flattens the monthly sum but escalates the interest you pay overall.

This trade-off underscores the importance of using Garanti BBVA’s tools—like their official calculator or an in-branch simulation session—to find the sweet spot. If you prefer stability in your finances, you might choose 60 months purely to avoid monthly strain. On the other hand, if your income is robust and consistent, leaning toward fewer months might be better. Another factor is whether you foresee changes: a job promotion that allows for higher payments soon or an external life event prompting tighter budgeting. The bank typically allows partial prepayments if your finances improve, though you must read the contract for potential early repayment fees or conditions.

Additionally, consider any possible administrative fees or mandatory credit insurances. Sometimes banks will present a “1.05% monthly interest” marketing pitch but incorporate a small opening fee plus insurance coverage, slightly bumping the effective rate. Observing the total cost, known as the CET or the overall interest for the entire period, clarifies your real financial obligation. Also, note that if you want your money on the “same day,” you typically need to finalize the application early enough and ensure all documents are in order.

Quick Tip:

Try simulating multiple payoff timelines. This helps you see how drastically your monthly sums differ if you pick 24, 36, or 60 months, and how that affects total interest.

4. Chart for Quick Compariso

Let’s visualize the differences in possible loan structures under this Garanti BBVA promotion:

| Loan Term | Monthly Rate | Approx. Monthly Payment | Total Interest Over Life |

|---|---|---|---|

| 12 Months | 1.05% | Higher monthly costs | Lower overall interest |

| 24 Months | 1.05% | Moderately high payment | Moderate total interest |

| 36 Months | 1.05% | More balanced approach | Increases cumulative interest |

| 60 Months | 1.05% | Lowest monthly cost | Highest interest paid |

5. Insights from Two Real Borrowers in Turkey

Testimony 1: Alp, from Istanbul

“When I discovered Garanti BBVA was offering a special 20,000 TRY loan at 1.05% monthly, I was skeptical. But after I lost some freelance work, I needed a short-term solution to cover rent and groceries. The application was straightforward: I went to a local branch with my pay stubs. They completed a quick credit check, verifying I had no major defaults. My biggest surprise was how swiftly the bank handled everything. By the late afternoon, the funds were in my account, meeting the ‘same-day’ claim they advertised. I opted for 24 months, feeling it balanced monthly affordability with limiting the total interest. I appreciate the comfortable space it gave me to repay without overwhelming my budget. My main advice is to confirm if the bank includes any insurance fees in that 1.05%—the staff explained it thoroughly, so I felt confident finalizing the deal.”

Testimony 2: Derya, from Ankara

“My story is about wanting to pay off two credit card balances that collectively had higher rates. So, stumbling upon this 20,000 TRY special from Garanti BBVA seemed like a bright idea: unify my obligations into one consistent monthly bill at 1.05%. Though I considered a fintech solution, I preferred going physically to a bank for peace of mind. The next day, I was signing the contract, and the funds covered my card debts almost instantly. Since I spread the payments over 36 months, my monthly outlay wasn’t too painful, but I’ll end up paying more total interest than if I had chosen 12 or 24 months. If you’re in my situation—wanting to eliminate high card rates—definitely weigh how quickly you can pay. The staff was helpful, and I appreciated their transparency about the origination fee and potential insurance costs. Now, I’m on track to finish these installments faster than if I’d stayed with my old card rates.”

6. Common Fees and Potential Pitfalls

Though Garanti BBVA promotes a 1.05% monthly rate for 20,000 TRY with same-day release, you’d be wise to look out for possible additional costs. Several categories of fees may arise:

• Opening Fee:

Some banks call it an “origination fee” or “application fee,” occasionally hidden within marketing language. Even if it’s small, it raises your effective interest cost.

• Insurance or Mandatory Protection:

Some institutions automatically enroll you in credit insurance to protect against job loss or disability. While beneficial for some, it might slightly increase your monthly payment.

• Early Repayment Penalties:

Even if you see yourself paying the debt in 60 months, you might decide to settle early. If the bank charges for that, the advantage of early payoff is partially negated.

• Late Payment Fees:

Failing to pay on time can lead to interest surcharges or negative reports to credit bureaus, damaging your credit score.

When you examine the contract in detail, ensure the monthly rate you see (1.05%) remains consistent. Some promotions apply it only to a certain portion of the loan’s duration or under specific conditions, such as maintaining a salary account with the bank. If you plan to switch or close that account mid-way, the interest can revert to a higher bracket. Also, check if same-day disbursement requires you to finish all paperwork by midday or if certain documentation is incomplete, possibly resulting in a next-day deposit. By verifying every detail, you avoid confusion that leads to disappointment or unexpected shortfalls in your finances.

Quick Tip:

If you have the means to pay off part of the principal earlier, confirm whether that partial prepayment triggers an additional administrative charge. Some banks might welcome partial prepayments without penalty, helping you cut future interest.

7. Why Garanti BBVA?

Türkiye’s financial sector is home to numerous reputable banks, so what sets Garanti BBVA apart for this specific short-term promotion? One reason is brand recognition: many Turkish citizens value institutions with a robust presence and a track record of reliability. Garanti BBVA has historically performed well in customer satisfaction indices, especially among mid-range income earners who rely on personal loans for diverse needs—like covering tuition fees, bridging home repairs, or consolidating high-interest debts from credit cards.

Additionally, the bank invests heavily in digital channels. Even if you prefer to finalize the agreement at a physical branch, you can accomplish the initial steps (like checking your potential interest rate) online. This hybrid approach merges modern convenience with old-school reassurance. Another draw is the bank’s extended customer service hours or at least a well-established support system. Borrowers can glean clarity on statements, review payoff progress, or request reevaluations if their credit profile changes significantly.

Ultimately, the star attraction in this promotional message is the “1.05% monthly” rate for up to 60 months. Some banks or fintechs remain reluctant to lock in interest rates that low for extended durations, thus making Garanti BBVA’s deal distinctive. However, like any marketing push, it may be time-limited or subject to your credit history. Seasoned consumers weigh whether the bank’s requirement (like opening an account or buying optional insurance) overshadow the potential savings. Those who handle the details proactively often find the synergy of an established brand and a competitive interest rate beneficial.

Quick Tip:

If you anticipate possibly needing future financial services—like a mortgage or car loan—building a good rapport with Garanti BBVA now may yield better terms or easier approvals down the line.

8. Statistics and Market Outlook for Personal Loans in Türkiy

The personal loan market in Türkiye has grown steadily, with many individuals opting for small to mid-sized financing solutions from mainstream banks. According to some industry insights, personal loans under 50,000 TRY soared in popularity over the last 3–5 years, partly due to the country’s dynamic urban expansions and the rising cost of everyday living. This trend has forced banks like Garanti BBVA to remain competitive, unveiling promotions with interest rates that appear lower than the national average.

Surveys show that a significant chunk of borrowers channel personal loans into debt consolidation or housing improvements. Meanwhile, a subset invests in short-term business endeavors, bridging capital needs for micro-entrepreneurs. Among these, an impressive portion highlights interest rates as their top deciding factor, overshadowing even brand loyalty in many cases. Another interesting statistic: almost half of first-time borrowers in the country prefer applying through digital or phone channels, a pivot from the older generation that heavily favored in-person visits.

Furthermore, a sizable portion of personal loans—some estimates hover around 30%—is allocated to educational expenses, both for children and adult reskilling courses. This signals a desire among Turks to invest in long-term career development. Meanwhile, around 20% revolve around medical or emergency-driven borrowing, reinforcing the need for easy, same-day approvals like the one Garanti BBVA offers. Overall, the sector is neither static nor monolithic. Banks continually revise terms, adjusting to consumer demands, market interest swings, and broader economic conditions. As a prospective borrower, these dynamic shifts could mean more competitive deals like the 1.05% monthly rate being introduced in promotional windows.

Bullet Points

• The 20,000 TRY range is popular for credit card consolidation

• 1.05% monthly interest can significantly cut costs if you have higher-rate debts

• Checking additional fees is crucial for exact cost clarity

• Many borrowers appreciate the 60-month extension to reduce monthly burdens

4 Updated FAQs

How can I ensure I qualify for the special 1.05% interest rate?

This promotional deal typically targets borrowers with moderate or high credit scores. The bank may also require stable employment proof. Adhering to any related conditions, like depositing your salary in a Garanti BBVA checking account, might secure the advertised 1.05%.

Does “same-day” disbursement apply at any time of day?

Not always. Often, you must finish the application and sign relevant documents before a cutoff hour (e.g., midday) for same-day deposit. If you apply late, the funds may arrive the following business day. Confirm specifics with a branch or the official helpline.

Is there a penalty if I want to pay off the 20,000 TRY loan early?

That depends on your contract. While some promotions either waive or minimize early repayment penalties, others impose a small fee. If you believe you can settle your debt faster, check if those fees exist or whether partial prepayments remain penalty-free.

What if I have prior credit issues on record—can I still get approved?

Garanti BBVA typically reviews your credit records. Mild or older delinquencies might not block you outright, but they could raise your interest or introduce additional conditions. A major or recent default might result in denial or the need for a guarantor. Ultimately, it’s best to speak directly with a loan specialist.

Related Topics

• Turkish Banking Regulations

• Personal Loan Consolidation

• Low-Interest Promotional Offers

• Debt Management Strategies

• Insurance-Linked Credit Solutions