Anúncios

Small loans between €1,000 and €5,000 represent the most popular borrowing range in Italy, perfect for covering unexpected expenses, home improvements, or bridging temporary financial gaps.

This comprehensive guide explores 6 excellent loan options in this range, helping you find the perfect solution for your specific needs with competitive rates and favorable terms.

Why Small Loans Are Popular in Italy

Small personal loans have become increasingly popular among Italian borrowers due to their accessibility and practical applications for everyday financial needs.

Common Uses:

• Emergency medical expenses

• Home appliance replacements

• Car repairs and maintenance

• Vacation funding

• Debt consolidation for smaller amounts

Anúncios

Market Advantages:

• Faster approvals due to lower risk assessment

• Better rates than credit cards for larger purchases

• Manageable payments fitting most budgets

• Less documentation required compared to larger loans

The 6 Best Small Loan Options

1. BancoPosta Mini Prestito

Loan Range: €500 – €3,000

BancoPosta’s Mini Prestito program specifically targets small borrowing needs with simplified applications and competitive rates through Italy’s extensive postal network.

Key Features:

• TAEG rates: 6.8% – 12.5%

• Repayment terms: 12 – 36 months

• Available at any post office

• No bank account required

• Simple application process

Advantages:

• Accessible through 13,000 post offices

• Evening and Saturday hours available

• Friendly for customers without traditional banking

• Quick approval process (24-48 hours)

Perfect For

Customers who prefer in-person service or have limited access to traditional banking services.

Monthly Payment Examples:

• €1,000 over 24 months: €48-€52

• €3,000 over 36 months: €95-€105

• €5,000: Not available through this program

2. Findomestic Small Loans

Loan Range: €1,000 – €5,000

Findomestic excels in the small loan market with competitive rates and flexible terms designed specifically for modest borrowing needs.

Product Details:

• Interest rates: 3.9% – 9.8% TAEG

• Terms available: 12 – 60 months

• 100% online application

• Same-day approval possible

• No early repayment penalties

Special Benefits:

• Skip-a-payment option annually

• Flexible payment dates

• Digital loan management

• Optional payment protection

Findomestic’s Advantage

Offers the most competitive rates in the small loan category with excellent digital tools for loan management.

Payment Examples:

• €1,000 over 24 months: €43-€47

• €3,000 over 36 months: €88-€96

• €5,000 over 48 months: €112-€124

3. Compass Personal Loans

Loan Range: €1,000 – €5,000

Compass provides reliable small loan solutions with personalized service and competitive terms for borrowers seeking individual attention.

Loan Features:

• TAEG starting: 4.2% – 11.5%

• Repayment: 12 – 60 months

• Same-day approval available

• Branch and online applications

• Debt consolidation options

Customer Benefits:

• Personal consultation available

• Flexible payment scheduling

• Combination with existing loans

• Regional branch network

Personal Touch

Compass combines digital efficiency with personal banking relationships for customers preferring human interaction.

Cost Examples:

• €1,500 over 24 months: €68-€74

• €3,500 over 36 months: €105-€115

• €5,000 over 48 months: €112-€125

4. Intesa Sanpaolo Quick Loans

Loan Range: €1,000 – €5,000

Italy’s largest bank offers small loan solutions with preferential rates for existing customers and comprehensive banking integration.

Product Specifications:

• Interest rates: 4.5% – 10.8% TAEG

• Duration: 12 – 60 months

• Instant pre-approval for customers

• Mobile app management

• Automatic payment setup

Customer Advantages:

• Existing customer discounts (0.3% – 0.8%)

• Integrated with other banking services

• Comprehensive branch network

• Priority customer service

Banking Integration

Perfect for customers who want their loan integrated with their main banking relationship.

Monthly Costs:

• €2,000 over 24 months: €88-€95

• €4,000 over 36 months: €118-€128

• €5,000 over 48 months: €112-€122

5. Revolut Personal Loans

Loan Range: €1,000 – €5,000

Revolut’s digital-first approach delivers fast approvals and modern banking features for tech-savvy borrowers seeking efficiency.

Digital Features:

• TAEG rates: 5.7% – 13.2%

• Terms: 12 – 48 months

• Instant approval (30 minutes – 2 hours)

• 100% mobile application

• Real-time notifications

Modern Benefits:

• Complete digital experience

• Instant spending insights

• Automatic categorization

• Multi-currency support

Speed Champion

Ideal for customers who need quick funding and prefer managing finances entirely through smartphone apps.

Payment Structure:

• €1,000 over 12 months: €88-€92

• €3,000 over 24 months: €135-€145

• €5,000 over 36 months: €151-€165

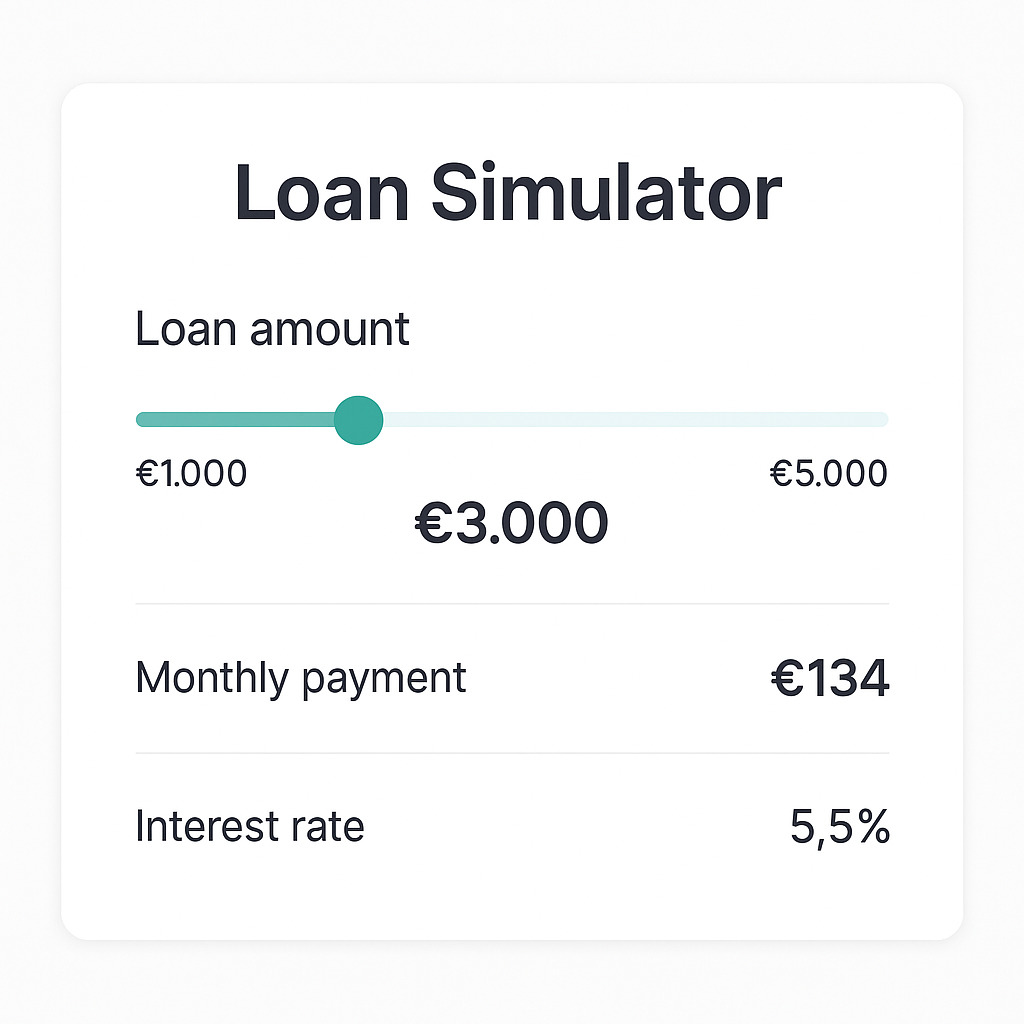

6. Crédit Agricole Small Loans

Loan Range: €1,000 – €5,000

Crédit Agricole brings French banking expertise to Italy’s small loan market with competitive rates and European banking standards.

Loan Characteristics:

• Interest rates: 5.5% – 12.0% TAEG

• Repayment terms: 12 – 60 months

• Multilingual customer service

• European banking standards

• Competitive rate negotiations

International Benefits:

• European network access

• Multilingual support

• International banking experience

• Stable rate structures

European Expertise

Excellent choice for international residents or customers with European banking needs.

Cost Breakdown:

• €1,500 over 18 months: €87-€93

• €3,500 over 30 months: €122-132

• €5,000 over 42 months: €126-€138

Comparison Table

| Lender | Best Rate | Fastest Approval | Max Amount |

|---|---|---|---|

| Findomestic | 3.9% TAEG | Same day | €5,000 |

| BancoPosta | 6.8% TAEG | 24-48 hours | €3,000 |

| Revolut | 5.7% TAEG | 30 minutes | €5,000 |

Choosing the Right Small Loan

Selecting the optimal small loan depends on your specific situation, urgency, and banking preferences.

Consider Your Timeline

Immediate Needs (1-2 days):

• Revolut: 30 minutes – 2 hours

• Findomestic: Same day possible

• Compass: Same day with branch visit

Standard Timeline (3-7 days):

• Intesa Sanpaolo: 2-5 days

• Crédit Agricole: 3-7 days

• BancoPosta: 2-4 days

Emergency Strategy

For true emergencies, apply to Revolut first, then Findomestic as backup while waiting for initial response.

Rate Shopping Strategy

Best Overall Rates:

• Findomestic: Starting at 3.9% TAEG

• Compass: Starting at 4.2% TAEG

• Intesa Sanpaolo: Starting at 4.5% TAEG

Rate Improvement Tactics:

• Apply to multiple lenders

• Negotiate with existing bank relationships

• Consider automatic payment discounts

• Time applications during promotional periods

Hidden Cost Awareness:

• Monthly account fees

• Processing charges

• Insurance premiums

• Early payment restrictions

Documentation Requirements

Universal Documents:

• Valid identification (passport or Italian ID)

• Proof of income (pay stubs or tax returns)

• Bank statements (3-6 months)

• Proof of residence

Simplified Requirements:

• BancoPosta: Minimal documentation

• Revolut: Digital verification only

• Existing bank customers: Reduced paperwork

Preparation Tips

Gather all documents before applying to any lender to ensure fastest possible processing across all options.

Application Strategies for Success

Maximize your approval chances and secure the best terms with these proven strategies.

Profile Optimization

Financial Preparation:

• Maintain stable account balances

• Establish regular income patterns

• Pay existing debts consistently

• Avoid new credit inquiries before applying

Banking Relationships:

• Consider applying with your current bank first

• Maintain good account standing

• Use direct deposit for salary

• Keep accounts active and healthy

Timing Considerations

Apply early in the month when banks have fresh lending quotas and during weekdays for faster processing.

Application Best Practices

Accuracy is Critical:

• Double-check all personal information

• Provide exact employment details

• Use consistent name formatting

• Verify contact information

Purpose Clarity:

• Be specific about loan purpose

• Choose standard categories when possible

• Avoid vague descriptions

• Provide supporting documentation if needed

Amount Selection:

• Request amounts within your means

• Consider debt-to-income ratios

• Allow room for unexpected expenses

• Choose amounts that qualify for best rates

Negotiation Opportunities

Rate Improvements:

• Mention competitive offers

• Highlight positive banking history

• Propose automatic payments

• Consider longer terms for lower payments

Fee Reductions:

• Ask about waived processing fees

• Negotiate management fee discounts

• Request free payment protection

• Inquire about loyalty program benefits

Professional Approach

Remain polite but persistent when negotiating, emphasizing your value as a customer and long-term relationship potential.

Managing Small Loans Effectively

Once approved, smart loan management ensures positive financial impact and builds credit for future needs.

Payment Strategies

Automatic Payments:

• Set up automatic deductions

• Choose optimal payment dates

• Maintain sufficient account balances

• Monitor for payment confirmations

Extra Payment Benefits:

• Reduce total interest costs

• Shorten loan duration

• Improve credit standing

• Create financial flexibility

Payment Timing

Schedule payments shortly after payday to ensure sufficient funds and avoid late fees that can add significant costs.

Loan Monitoring

Regular Reviews:

• Check account statements monthly

• Monitor interest charges

• Track principal reduction

• Watch for rate changes

Early Payoff Considerations:

• Calculate total interest savings

• Verify no prepayment penalties

• Consider investment alternatives

• Maintain emergency fund balance

Common Mistakes to Avoid

Learn from others’ experiences to maximize your small loan success.

Application Errors

Documentation Problems:

• Incomplete applications delay processing

• Poor quality document photos cause rejections

• Outdated information creates verification issues

• Missing signatures void applications

Information Inconsistencies:

• Income misstatements trigger additional verification

• Employment details must match exactly

• Bank account information errors delay funding

• Contact information mistakes prevent communication

Financial Missteps

Overextending:

• Borrowing more than necessary increases costs

• Multiple simultaneous applications hurt credit scores

• Ignoring total monthly payment capacity

• Failing to account for existing obligations

Poor Planning:

• Not shopping around for best rates

• Accepting first offer without comparison

• Ignoring fee structures

• Misunderstanding repayment terms

Prevention Strategy

Take time to research, compare options, and carefully review all terms before committing to any small loan.

Frequently Asked Questions

Q: What’s the minimum income required for €1,000-€5,000 loans?

A: Most lenders require €800-€1,200 monthly net income, though specific requirements vary by lender and loan amount.

Q: Can I get approved with a temporary work contract?

A: Yes, several lenders accept temporary contracts, but you may need to provide additional documentation or accept higher rates.

Q: How do small loan rates compare to credit card rates?

A: Small personal loans typically offer rates 3-8 percentage points lower than credit card interest rates, making them more cost-effective for larger purchases.

Q: Is it better to take one €5,000 loan or multiple smaller loans?

A: One larger loan is typically more cost-effective due to lower fees and better rates, but multiple smaller loans offer more flexibility.

Conclusion

Small loans between €1,000 and €5,000 offer excellent flexibility for managing life’s financial challenges in Italy.

Findomestic leads with the best rates, while Revolut excels in speed and digital convenience.

Success with small loans requires careful comparison shopping, accurate applications, and responsible repayment management.

With the right approach, these loans provide valuable financial tools for achieving your short-term goals.