Anúncios

When purchasing a home, one of the most consequential financial decisions you’ll make isn’t just about which property to buy—it’s about how to structure your mortgage.

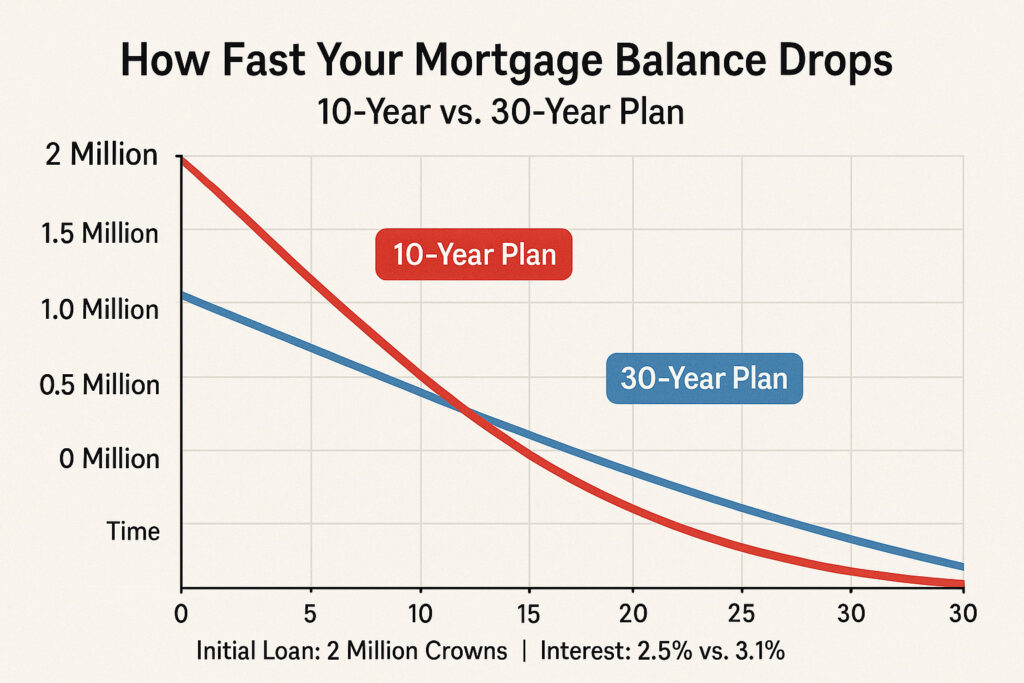

The repayment term significantly impacts your monthly budget, total interest paid, and long-term financial flexibility. This article examines the striking differences between repaying a 2 million crown mortgage over 10 years versus the more traditional 30-year period, while also comparing fixed and variable rate options.

The Fundamental Trade-Off: Monthly Payment vs. Total Cost

The most obvious difference between shorter and longer mortgage terms is the monthly payment amount. However, the total cost difference over the life of the loan is equally important and often overlooked.

Monthly Payment Comparison

For a 2 million crown mortgage with a 2.5% fixed interest rate:

• 10-year term: Monthly payment of approximately 18,870 crowns

• 30-year term: Monthly payment of approximately 7,900 crowns

This represents a difference of nearly 11,000 crowns per month—equivalent to what many people spend on all other living expenses combined. For many households, this determines whether a particular property is affordable at all.

Total Interest Paid

The difference in total interest paid over the life of the loan is staggering:

Anúncios

• 10-year term: Total interest of approximately 264,400 crowns

• 30-year term: Total interest of approximately 844,600 crowns

With a 30-year mortgage, you ultimately pay more than three times the interest compared to a 10-year term. This difference of 580,200 crowns could fund retirement investments, children’s education, or purchase of a vacation property.

Amortization Schedule: 10-Year vs. 30-Year Fixed Rate Mortgage

Key insights from the amortization comparison:

•Equity Building: After 5 years with a 10-year mortgage, you’ve paid off approximately 50% of the principal. With a 30-year mortgage, you’ve only paid off about 14% in the same period.

• Interest vs. Principal: In the first year of a 10-year mortgage, about 73% of your payment goes toward principal. In a 30-year mortgage, only about 35% of your initial payments reduce the principal.

• Break-even Point: The 10-year mortgage borrower will have completely paid off their loan while the 30-year borrower will still owe about 1.4 million crowns at the 10-year mark.

Monthly Payment Allocation: Where Your Money Goes

With a 10-year mortgage, your first monthly payment of 18,870 crowns would typically include:

• Principal repayment: 14,000 crowns

• Interest payment: 4,870 crowns

With a 30-year mortgage, your first monthly payment of 7,900 crowns would include:

• Principal repayment: 2,900 crowns

• Interest payment: 5,000 crowns

This illustrates why longer mortgage terms result in significantly more interest paid over time—early payments are predominantly interest rather than principal reduction.

Fixed vs. Variable Rate Comparison

The choice between fixed and variable rate mortgages adds another layer of complexity to the 10-year vs. 30-year decision.

Current Rate Environment (2025)

| Rate Type | 10-Year Term | 30-Year Term |

|---|---|---|

| Fixed Rate | 2.5% | 3.1% |

| Variable Rate (initial) | 1.8% | 2.3% |

Total Cost Comparison with Different Rate Types

For a 2 million crown mortgage:

10-Year Fixed (2.5%)

• Monthly payment: 18,870 crowns

• Total interest: 264,400 crowns

10-Year Variable (starting at 1.8%)

• Initial monthly payment: 18,300 crowns

• Total interest if rates remain unchanged: 196,000 crowns

• Total interest if rates increase by 1% after 3 years: 236,000 crowns

30-Year Fixed (3.1%)

• Monthly payment: 8,550 crowns

• Total interest: 1,078,000 crowns

30-Year Variable (starting at 2.3%)

• Initial monthly payment: 7,740 crowns

• Total interest if rates remain unchanged: 786,400 crowns

• Total interest if rates increase by 1% after 5 years: 963,000 crowns

The Risk Factor: Interest Rate Sensitivity

Variable rate mortgages are significantly more sensitive to interest rate changes with longer terms:

• A 1% rate increase on a 10-year variable mortgage increases the monthly payment by approximately 520 crowns

• The same 1% increase on a 30-year variable mortgage increases the monthly payment by approximately 1,050 crowns

This greater sensitivity makes longer-term variable mortgages considerably riskier, especially in uncertain economic environments.

Real-Life Budget Impact

To understand the practical implications of these different mortgage structures, consider how they would affect a household with a monthly net income of 50,000 crowns:

| Mortgage Type | Monthly Payment | % of Income | Remaining for Other Expenses |

|---|---|---|---|

| 10-Year Fixed | 18,870 crowns | 37.7% | 31,130 crowns |

| 30-Year Fixed | 8,550 crowns | 17.1% | 41,450 crowns |

| 10-Year Variable | 18,300 crowns | 36.6% | 31,700 crowns |

| 30-Year Variable | 7,740 crowns | 15.5% | 42,260 crowns |

The 30-year options leave significantly more monthly budget flexibility, but at the cost of much higher total interest and slower equity building.

The Bond-Based Mortgage System: A Unique Advantage

One distinctive feature of the mortgage system here is the bond-based mortgage structure. This creates a unique refinancing opportunity that affects the fixed vs. variable rate decision:

When interest rates rise, the market value of existing fixed-rate mortgage bonds decreases. This allows borrowers with fixed-rate mortgages to “buy back” their loans at a discount, effectively reducing their principal balance by repaying the bond at market value rather than face value.

For example, if interest rates rise from 3% to 5%, a borrower with a 2 million crown fixed-rate mortgage might be able to repurchase their loan for approximately 1.7 million crowns—instantly reducing their principal by 300,000 crowns.

This creates a valuable “hedge” feature for fixed-rate mortgages that isn’t available with variable rate loans. Consider this an insurance policy against rising interest rates that partially offsets the higher initial rate of fixed mortgages.

Life Scenarios: Which Mortgage Term Makes Sense?

Different life circumstances may make either a 10-year or 30-year mortgage more appropriate:

The 10-Year Mortgage Might Be Right If:

• You’re within 15 years of retirement and want to eliminate housing debt

• You have a high, stable income with substantial saving capacity

• You prioritize becoming debt-free over maximizing investment returns

• You plan to stay in the home long-term

• You’re concerned about future interest rate increases

The 30-Year Mortgage Might Be Right If:

• You’re early in your career with expectations of income growth

• You want to maximize current cash flow for other investments or expenses

• You have variable income or work in less stable industries

• You might sell the home within 10 years

• You’re comfortable with long-term debt to maximize financial flexibility

Case Study: The Jensen Family Decision

The Jensen family purchased a home requiring a 2 million crown mortgage. With a combined monthly income of 62,000 crowns after tax, they considered both 10-year and 30-year options.

They ultimately chose a 30-year fixed-rate mortgage, but with a twist: they committed to making voluntary additional principal payments of 3,000 crowns monthly. This strategy offered:

• The security of affordable required payments (8,550 crowns)

• The flexibility to pause extra payments during financial challenges

• A significant reduction in total interest paid (approximately 420,000 crowns saved)

• A shortened effective loan term from 30 years to about 19 years

This “hybrid approach” demonstrates how borrowers can customize their repayment strategy beyond the standard 10-year vs. 30-year choice.

Frequently Asked Questions

Is it possible to change from a 30-year to a 10-year mortgage later?

Yes, you can refinance to a shorter term at any point, usually paying closing costs of 0.5-1% of the loan amount. Interest rates for 10-year mortgages are typically 0.5-0.8% lower than 30-year options. The main consideration is whether your financial situation can handle the higher monthly payments.

What happens if interest rates rise significantly with a variable rate mortgage?

Your monthly payment will adjust when rates change. A 3% rate increase could raise a 30-year variable mortgage payment by up to 40%. Most lenders offer rate caps limiting increases per adjustment period (1-2%) and over the loan’s lifetime (5-6%). You can refinance to a fixed-rate mortgage, though available rates will reflect the higher interest environment.

Is it better to choose a shorter mortgage term or invest the difference?

This depends on mortgage interest rates versus potential investment returns and your risk tolerance. Stock markets have historically returned 7-10% annually, while recent mortgage rates have been 2-4%. Mortgage repayment offers a guaranteed return equal to your interest rate, while investments carry uncertainty. Many advisors recommend a balanced approach: choosing a 30-year mortgage while making extra payments when possible and also investing.

How does the bond-based mortgage system affect my decision?

The bond-based system creates an advantage for fixed-rate mortgages: if interest rates rise substantially, you can buy back your loan at a discount, effectively reducing your principal. This feature acts as interest rate insurance and is particularly valuable for 30-year fixed-rate mortgages, making them more attractive here than in other countries.

Can I make extra payments on my mortgage without penalties?

Most mortgages allow some form of extra payment without penalties. Fixed-rate mortgages typically allow unlimited extra payments. Some variable-rate mortgages, particularly those with the lowest initial rates, may restrict or charge fees for extra payments beyond 10-20% of the original principal annually. Always confirm prepayment terms before selecting a mortgage.

Conclusion

The choice between a 10-year and 30-year mortgage—and between fixed and variable rates—involves complex trade-offs between current affordability, total cost, financial flexibility, and risk management. While the 10-year mortgage offers substantial interest savings and faster equity building, the 30-year mortgage provides greater budget flexibility and the option to make strategic prepayments.

Many borrowers find that a hybrid approach works best: selecting a longer-term mortgage for the affordable required payment, but making additional principal payments when possible to reduce the effective term and total interest cost.

Remember that the “right” mortgage structure depends on your unique financial situation, goals, and risk tolerance. Consider consulting with an independent mortgage advisor who can provide personalized recommendations based on your specific circumstances.