Anúncios

A good credit score (kredi notu) is essential for securing loans with favorable rates, getting approved for premium credit cards, and even renting property in desirable neighborhoods.

If your KKB (Kredi Kayıt Bürosu) score is below ideal, you don’t need to wait years to improve it. With some strategic tactics, you can see significant improvements in just 30 days.

Why Your Credit Score Matters

Your KKB score is a number between 0 and 1,900 that represents your financial credibility. This score directly influences:

• The interest rates you pay on loans

• Your credit card limits

• Approval for vehicle and property financing

• Eligibility to rent properties without a guarantor

• Need for advance payment for utility services

Anúncios

The good news is that the scoring system is designed to respond quickly to positive financial behaviors. Let’s explore seven tactics that can improve your score in just one month.

1. Access and Analyze Your KKB Report

What to do:

The first step is to know exactly where you stand. The law allows you to access your credit report for free once a year through the e-Devlet portal. Alternatively, you can obtain paid reports directly from the KKB Findeks website.

Carefully analyze your report for:

• Overdue debts you weren’t aware of

• Accounts you don’t recognize (possible fraud)

• Errors in your payment history

• Excessive credit inquiries

How this helps:

Identifying and correcting errors can result in an immediate increase of 20-50 points. Approximately 25% of credit reports contain errors that negatively impact scores.

Local tip:

Use the e-Devlet integration to access your Findeks report for free through the mobile app. If you find errors, visit a bank branch in person with supporting documents, as corrections by phone may take longer.

2. Regularize Overdue Payments

What to do:

Prioritize paying overdue bills, especially credit card bills, personal loans, and service accounts. If you have many overdue debts, focus first on those approaching 90 days, as this is a critical threshold in the local banking system.

How this helps:

Late payments have an extremely negative impact on your score. Regularizing these debts can increase your score by up to 70-100 points in 30 days, as banks typically report updates to KKB on a monthly cycle.

Local tip:

For larger debts you cannot pay in full, visit the bank branch to negotiate a “debt restructuring plan” (borç yapılandırma). Many banks have special programs that allow your score to start improving as soon as you make the first payment of the renegotiated plan.

3. Reduce Credit Card Limit Usage

What to do:

Ideally, you should not use more than 30% of your total credit card limit. If you’re close to the limit, make an effort to reduce this percentage quickly, even temporarily:

• Make partial payments before the statement closing date

• Request a limit increase (if your income allows)

• Transfer part of the balance to another card with low usage

How this helps:

The relationship between balance and available limit (credit utilization) accounts for about 30% of your KKB score. Reducing this ratio can improve your score by 20-40 points in one month.

Local tip:

Take advantage of the “partial payment” (kısmi ödeme) functionality available in the most popular mobile banking apps, such as Garanti BbvaCep, İşCep, and EnPara. You can make multiple partial payments throughout the month, even before receiving the statement, which immediately reduces your credit utilization.

4. Become an Authorized User on Cards with Good History

What to do:

Ask a close family member (spouse, parent, or sibling) with excellent credit history to add you as an authorized user on one of their old cards with a good payment history.

How this helps:

When you’re added as an authorized user, you typically inherit part of the positive history of that card, which can add 10-25 points to your score in one reporting cycle.

Local tip:

This tactic works best with cards from private banks such as Yapı Kredi, Garanti BBVA, and İş Bankası, which typically report authorized users to KKB. State banks like Halk Bankası and Ziraat Bankası have less consistent reporting policies for authorized users.

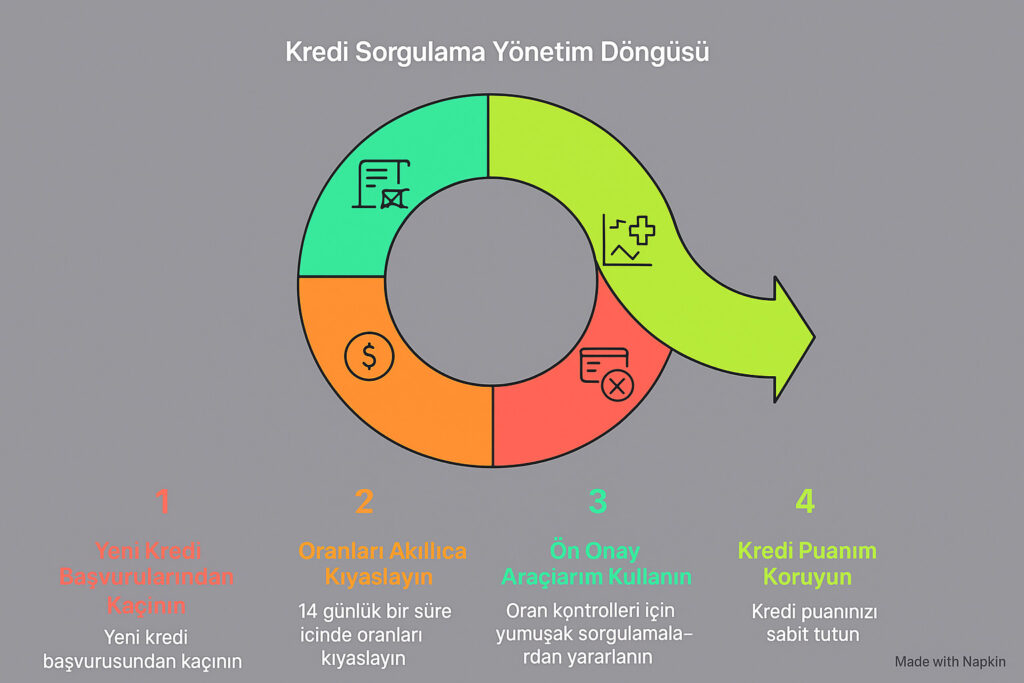

5. Avoid Multiple Credit Inquiries

What to do:

During this 30-day period, avoid applying for new credit cards, loans, or services that require checking your credit history. Each inquiry can temporarily reduce your score.

If you need to compare loan rates, do all your shopping within a 14-day period, as the system generally counts multiple inquiries of the same type in this period as a single inquiry.

How this helps:

Each new credit inquiry can reduce your score by 5-10 points, and these points are precious when you’re trying to improve quickly.

Local tip:

Use the “pre-approval” (ön onay) function available in banking apps. These checks are generally “soft inquiries” that don’t affect your score but allow you to see personalized rates and limits.

6. Keep Old Credit Accounts Active

What to do:

If you have old cards you no longer use, don’t cancel them. Instead, keep them active by making small monthly purchases (such as a streaming subscription or mobile top-up) and setting up automatic payment.

How this helps:

The average age of your credit accounts represents approximately 15% of your score. Older accounts improve this factor, potentially adding 15-30 points to your score.

Local tip:

Set up your old card to automatically pay your monthly Turkcell, Türk Telekom, or Vodafone bill. This is a simple way to keep the card active without the risk of forgetting, as these companies regularly report to KKB.

7. Register for the Financial Inclusion Program

What to do:

Register for the “Findeks Karekod” program that allows regular rent payments, utility services, and even subscriptions to be positively considered in your credit score, even though they are not traditional debts.

How this helps:

This relatively new program can add 30-60 points to your score by considering regular payments that would not normally be reported to the credit system.

Local tip:

Specifically ask your landlord to register your rent payments through the Findeks QR system. To facilitate adoption, offer to help them with online or mobile registration, as many landlords are unfamiliar with this system.

Credit Score Improvement Tactics Comparison

| Tactic | Potential Point Increase | Time to See Results | Difficulty Level |

|---|---|---|---|

| Correct report errors | 20-50 points | 2-4 weeks | Medium |

| Pay overdue accounts | 70-100 points | 1-5 weeks | High |

| Reduce credit utilization | 20-40 points | 1-2 weeks | Medium |

| Become authorized user | 10-25 points | 2-4 weeks | Low |

| Avoid new inquiries | 5-10 points (preserved) | Immediate | Low |

| Maintain old accounts | 15-30 points | 3-6 weeks | Low |

| Register for inclusion program | 30-60 points | 4-8 weeks | Medium |

Real Results: Ayşe’s Case

Ayşe, a 29-year-old teacher from Ankara, saw her KKB score drop to 1,050 after a period of financial hardship. By implementing these tactics, she achieved an increase of 175 points in 38 days:

• Corrected an error in the report (+45 points)

• Paid two overdue credit card bills (+60 points)

• Reduced credit card utilization from 90% to 25% (+40 points)

• Became an authorized user on her mother’s card (+15 points)

• Avoided new credit inquiries and kept old accounts active (+15 points)

This increase was enough for her to secure a personal loan offer with a rate 4% lower than she had previously received.

Frequently Asked Questions

How long does negative information remain on my KKB report?

Most negative information, such as late payments, remains for 3 years. Bankruptcies and debt-related legal proceedings may remain for 5 years. Debts referred to collection agencies usually remain visible for 3-5 years, depending on resolution.

Does canceling unused credit cards increase my score?

No, quite the opposite. Canceling old cards can reduce your score for two reasons: it decreases the average age of your accounts and increases your credit utilization ratio. It’s better to keep old cards with small monthly purchases.

Can I pay to remove negative information from my report?

No. Companies that promise to “clean” your credit history for a fee are generally fraudulent. The only legitimate way to remove negative information is if it’s incorrect (through dispute) or wait for it to naturally expire.

Do utility bill payments affect my credit score?

Traditionally, regular payments for bills such as electricity, water, and gas did not positively affect your score, but payment failures were reported negatively. With the new Findeks Karekod system, these regular payments can now positively contribute to your score.

How often is my KKB score updated?

The KKB score is generally updated monthly, when creditors report information. Some larger banks and credit card issuers update information every two weeks, but this varies. Therefore, some improvements may take up to 45 days to appear in your score.

Conclusion

Improving your credit score doesn’t have to be a slow process. By following these seven practical tactics adapted to local reality, you can see significant improvements in just 30 days. Remember that consistency is key to maintaining a good score in the long run.

After these initial 30 days of “quick recovery,” continue applying good financial habits, such as paying bills on time, maintaining low credit utilization, and regularly monitoring your report. Over time, your score will continue to improve, opening doors to better financial opportunities.

Important: If your financial situation is extremely complicated, consider seeking professional advice. Many banks offer free financial planning consultations for customers, and the government “Finansal Okuryazarlık” program provides free educational resources on credit management.