Anúncios

In today’s fast-paced world, financial needs can arise unexpectedly.

Whether it’s a medical emergency, an urgent home repair, or a time-sensitive business opportunity, having quick access to funds can make all the difference.

Turkish banks and fintech companies have responded to this need by developing mobile applications that promise loan approvals in minutes rather than days.

This guide explores the best mobile loan options in Turkey, how to use them safely, and what to watch out for.

What Are Instant Mobile Loans?

Instant mobile loans (Anında Kredi) are small to medium-sized personal loans that can be applied for, approved, and disbursed entirely through a mobile phone application. Unlike traditional loans that might take days or weeks to process, these loans promise approval decisions in minutes and fund transfers within hours or even minutes.

How They Differ from Traditional Loans

Traditional loans typically require in-person branch visits, extensive paperwork, and lengthy approval processes. Mobile loans simplify this by:

• Allowing full application through smartphone apps

• Using digital verification instead of physical documents

Anúncios

• Employing automated decision-making algorithms

• Providing 24/7 availability, including weekends and holidays

• Offering smaller loan amounts with shorter terms

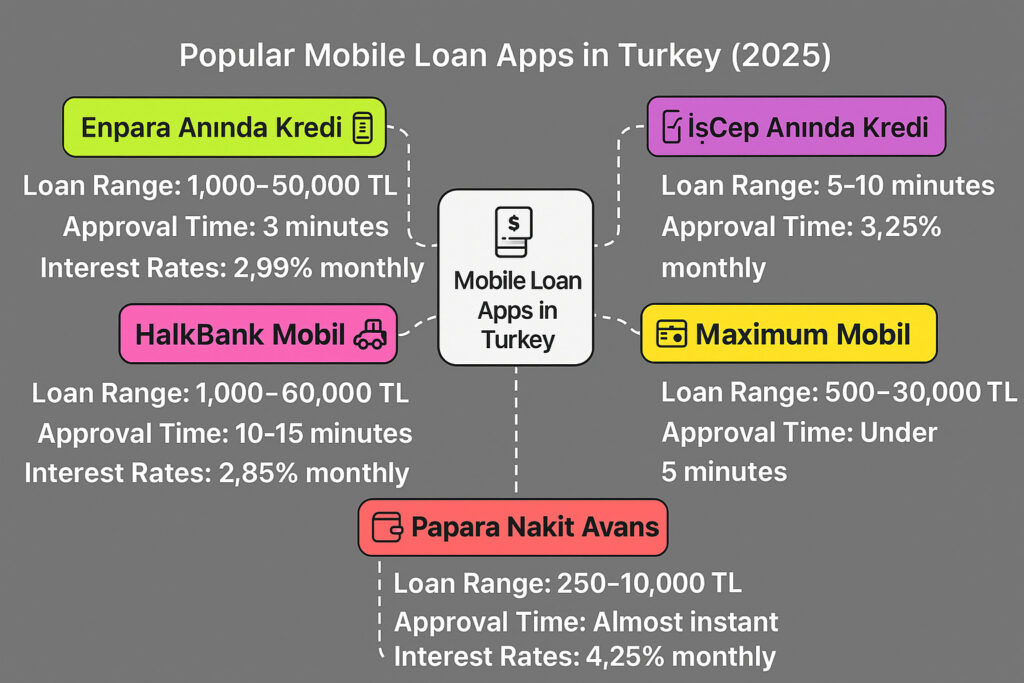

Popular Mobile Loan Apps in Turkey (2025)

Turkey’s digital lending landscape has evolved rapidly in recent years. Here are the leading applications offering instant loans:

Enpara Anında Kredi

QNB Finansbank’s digital banking platform Enpara offers one of Turkey’s most streamlined mobile loan experiences. Their “Anında Kredi” feature provides instant approval for existing customers.

• Loan range: 1,000 – 50,000 TL

• Approval time: As fast as 3 minutes

• Interest rates: Starting from 2.99% monthly

• Unique feature: No branch visits required, even for new customers

• Requirements: Turkish citizenship or residence permit, minimum 5,000 TL monthly income

İşCep Anında Kredi

İş Bank’s mobile application İşCep offers “Anında Kredi” with one of the highest instant approval limits in the market:

• Loan range: 1,000 – 100,000 TL

• Approval time: 5-10 minutes

• Interest rates: From 3.25% monthly

• Unique feature: Pre-approved amounts for existing customers

• Requirements: 6+ months İş Bank relationship or 7,500+ TL monthly income

Maximum Mobil

Türkiye İş Bankası’s credit card-linked app offers instant cash advances and loan options:

• Loan range: 500 – 30,000 TL

• Approval time: Under 5 minutes

• Interest rates: Based on customer profile (from 3.45% monthly)

• Unique feature: Can transfer funds directly to Maximum credit card for immediate use

• Requirements: Existing Maximum credit card holder with good payment history

HalkBank Mobil

This state bank offers competitive rates for government employees and pensioners:

• Loan range: 1,000 – 60,000 TL

• Approval time: 10-15 minutes during business hours

• Interest rates: Special rates for public servants (from 2.85% monthly)

• Unique feature: Pensioner-friendly with simplified verification

• Requirements: Turkish ID and income verification

Papara Nakit Avans

This fintech solution provides smaller emergency loans without traditional banking requirements:

• Loan range: 250 – 10,000 TL

• Approval time: Almost instant for verified accounts

• Interest rates: Higher than traditional banks (from 4.25% monthly)

• Unique feature: Available to users with limited credit history

• Requirements: Verified Papara account with regular income deposits

Step-by-Step Application Process

Most mobile loan apps in Turkey follow a similar application process. Here’s a general guide using Enpara as an example:

1. Download and install the app

From the App Store or Google Play Store, search for your preferred bank’s application and complete the basic registration

2. Complete identity verification

Verify your identity through video call verification or e-Government (e-Devlet) integration

3. Navigate to the loans section

Find the “Loans” or “Kredi” section within the app, then select “Instant Loan” (Anında Kredi)

4. Enter desired loan amount and term

Select how much you need to borrow and for how long (typically 3-36 months)

5. Review pre-approval offer

The app will display your pre-approved amount, interest rate, monthly payments, and total repayment amount

6. Complete income verification

Upload or connect to your income information (some apps can automatically verify via SGK integration)

7. Accept terms and sign digitally

Review all loan terms and digitally sign the agreement using a one-time password sent to your registered phone

8. Receive funds

Funds are typically deposited directly to your linked bank account within minutes to hours

Critical Factors to Consider

Before applying for an instant mobile loan, consider these important factors:

Real Interest Rates vs. Advertised Rates

Be aware that the advertised interest rate (nominal rate) is often lower than the Annual Percentage Rate (APR). In Turkey, this is called “Yıllık Maliyet Oranı” and includes all fees and charges.

Example: A loan advertised at 3.2% monthly interest might have a Yıllık Maliyet Oranı of over 50% annually when all fees are included.

Hidden Fees and Charges

Common fees to watch for include:

• Application fees (başvuru ücreti): 50-250 TL

• Administrative fees (dosya masrafı): Usually 0.5-1% of loan amount

• Insurance premiums (sigorta): Often mandatory but can be overpriced

• Early repayment penalties: Can be up to 2% of the remaining balance

Impact on Credit Score (KKB Score)

Each loan application is recorded on your credit report. Multiple applications in a short period can negatively impact your KKB (Kredi Kayıt Bürosu) score. Some apps offer “pre-qualification” checks that don’t affect your score.

Avoiding Scams and Fraudulent Apps

The popularity of instant loans has unfortunately led to numerous scams. Protect yourself by watching for these red flags:

1. Upfront fee requirements

Legitimate lenders never ask for payment before approving your loan

2. Unofficial app stores or direct downloads

Only download banking apps from official app stores (Google Play or App Store)

3. Poor app ratings or few reviews

Check user ratings and read reviews before installing

4. Unrealistic promises

Be suspicious of guaranteed approval or “no credit check” claims

5. Unprofessional communication

Watch for poor grammar, spelling errors, or unprofessional communication

6. Excessive permission requests

Be cautious if the app requests unnecessary permissions like access to your contacts or location at all times

7. Pressure tactics

Legitimate lenders don’t use high-pressure tactics or time-limited offers

Real User Experience: Mehmet’s Story

Mehmet, a 35-year-old shop owner in Istanbul, needed 15,000 TL quickly when his refrigeration unit broke down unexpectedly. His experience highlights both benefits and cautions:

“I applied through İşCep at 10 AM on Tuesday when my store freezer failed. By 10:08 AM, I had approval for 15,000 TL, and the money was in my account before noon. However, I was surprised by the 290 TL ‘administrative fee’ that wasn’t prominently displayed during application. The process was incredibly convenient, but the total cost was higher than I initially understood.”

Mehmet recommends: “Take screenshots of each step of the application, especially the interest rates and fees page. Read every detail before accepting.”

Frequently Asked Questions

Is it possible to get an instant loan as a foreigner in Turkey?

Yes, but with limitations. Most apps require at least a residence permit and 1+ year of residency. Foreign customers typically face stricter income requirements (often 50-100% higher than for citizens) and may receive lower loan limits. Papara and Enpara offer the most foreigner-friendly options.

How much can I borrow through mobile apps?

For first-time borrowers, limits typically range from 1,000-25,000 TL. After establishing a repayment history, this can increase to 50,000-100,000 TL for customers with excellent credit and verified high income.

Can I get an instant loan with a poor credit score?

Traditional banks’ mobile apps generally require a KKB score of at least 1300-1400. However, newer fintech platforms like Papara offer smaller amounts (up to 3,000-5,000 TL) to customers with limited or imperfect credit histories, though at higher interest rates.

How fast will I actually receive the money?

Approval decisions typically come within 5-15 minutes during business hours. Fund disbursement varies: same-bank transfers usually complete within minutes, while transfers to other banks may take 1-3 hours. Weekend and holiday applications may face delays until the next business day.

What happens if I miss a payment?

Late payment penalties are severe in Turkey. Most lenders charge daily default interest (temerrüt faizi) between 0.15-0.2% per day (translating to 54-73% annually). Multiple missed payments will severely damage your credit score and may result in legal proceedings after 90 days.

Conclusion

Mobile instant loans offer unprecedented convenience for meeting urgent financial needs in Turkey. The best applications provide genuinely quick decisions and funding, often completing the entire process in less than an hour.

However, this convenience comes at a cost – interest rates and fees are typically higher than traditional loans, and the streamlined application process might cause borrowers to overlook important terms and conditions.

Before applying, compare options from multiple providers, carefully review all fees and conditions, and borrow only what you can comfortably repay. Used responsibly, these tools can provide valuable financial flexibility in emergency situations.

Remember that the fastest loan isn’t always the best loan – taking an extra hour to compare offers could save you thousands of lira in the long run.